Navigating market entry, scalable growth, and residual value risk in a fragmented market.

The growing presence of Chinese electric vehicles (EV) on offer in Europe raises questions about competitive pressure, market dynamics, and their impact on established vehicles manufacturers in Europe and their products.

Our next webinar offers a comprehensive analysis of the strategic positioning of these new entrants and their influence on both the new and used vehicle markets.

Join us on 16 September at 09:30 BST / 10:30 CEST, as we answer questions like:

- Which Chinese EV brands and models are currently available in Europe, and what has their impact been so far?

- What does it take for new entrants to build traction in Europe’s regulated, diverse and brand-sensitive market?

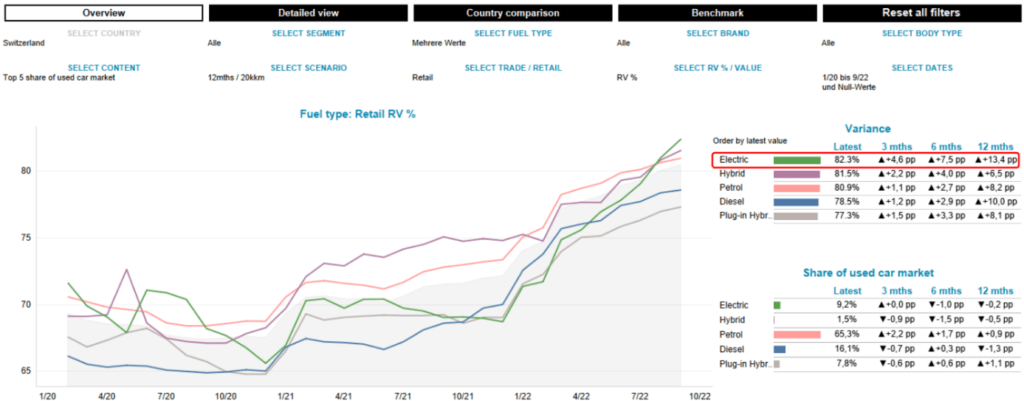

- How are new market entrants already impacting European used-vehicle dynamics?

Meet the panellists

Here are the thought leaders bringing real-world perspectives on market entry, growth, and value.

- Christoph Ruhland, Director of Business Development, Autovista Group

- Christian Schneider, Director of Content, EV Volumes

- Dr. Christof Engelskirchen, Chief Economist & Director Valuations and Forecasts, Autovista Group

- Tom Geggus, Editor, Autovista24

What you’ll gain

This webinar offers key insights for both newcomers and established players, including:

- A clear view of Chinese EV brands making waves across Europe and how the market is responding.

- How new entrants are localising production, navigating EU policies, and competing in a new market.

- How these brands are reshaping the used-EV market dynamics.

- Whether established OEMs are still leading the charge in resale value, brand trust, and fleet viability

Who should attend?

This webinar is designed for professionals navigating Europe’s shifting EV market.

- OEMs – Learn what it takes to successfully enter the European automotive market.

- Leasing and fleet managers – Get to grips with the latest market arrivals.

- Finance, insurance, and risk analysts – Gain data-driven insights on competitive dynamics reshaping the market.

- Remarketing specialists – Explore what these changes mean for resale and pricing.

- Industry executives and stakeholders – Stay ahead of emerging EV trends and their impact on investment risk.

Understanding the market disruptors and growth strategies can make all the difference when navigating through Europe’s evolving EV market.

Don’t just watch the shift, be part of it.

Stäng

Stäng