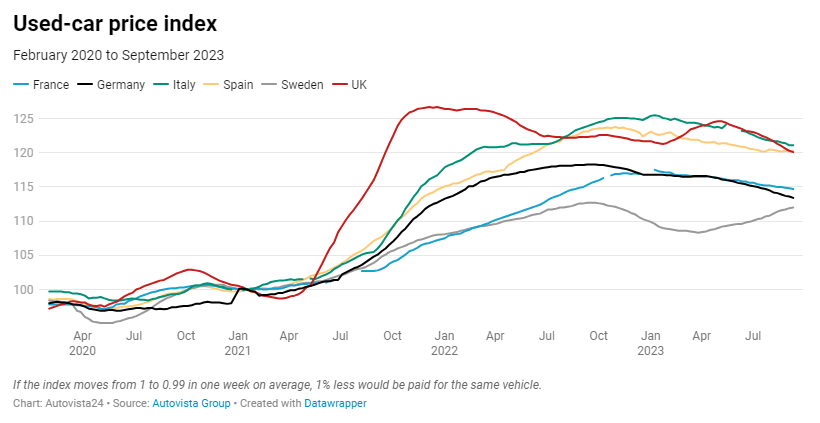

While many European markets have seen used-car prices fall last year, Sweden has managed to buck this trend, thanks to non-plug-in vehicles. Jere Sillanpää, valuation manager for Finland and Sweden at Autovista Group, explains why.

Consumer savings in Sweden were bolstered during the COVID-19 lockdowns, as spending money on trips abroad or eating out at restaurants was simply not possible. Interest rates were also very low, and funds were redirected towards more expensive purchases, including housing and transportation. This resulted in increased demand for new and used cars.

Trend reversed

However, the trend has reversed over the past year, with inflation and interest rates rocketing upwards, hitting Sweden particularly hard. ‘Eternal’ mortgages are considered relatively common in the country and as these costs climb, consumers have begun avoiding expensive purchases.

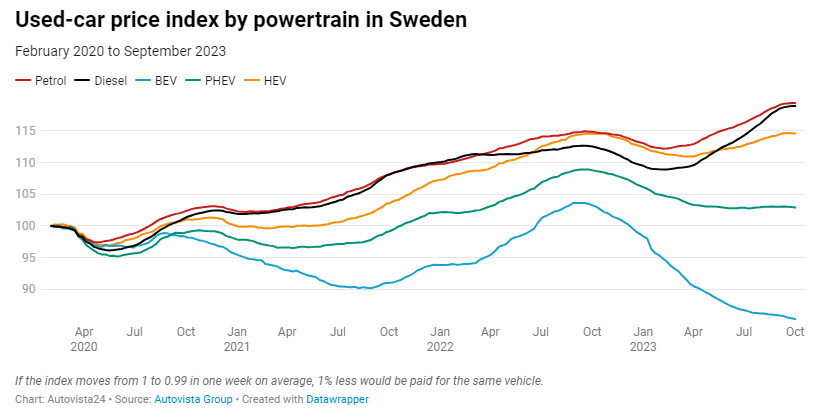

This includes new cars and expensive used models, most of which are electric vehicles (EVs), made up of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs). But for some, changing vehicles has been unavoidable, pushing the uptake of cheaper internal-combustion engine (ICE) models.

Sales down, exporting up

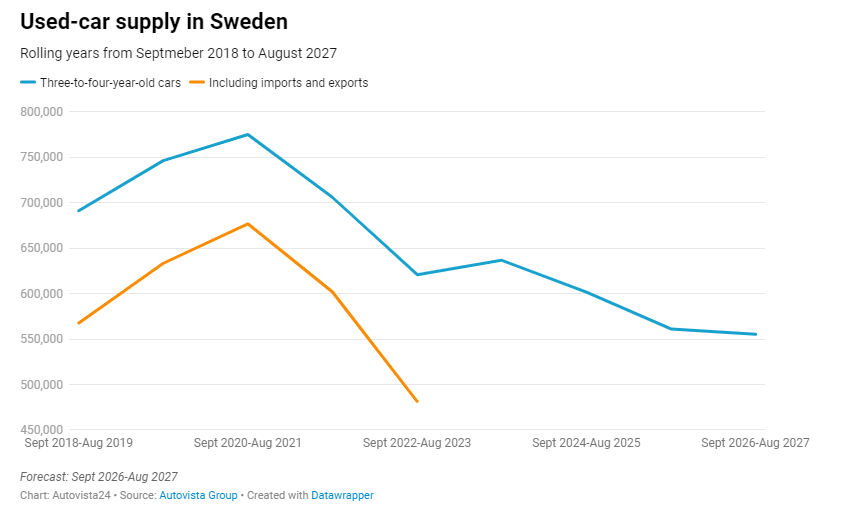

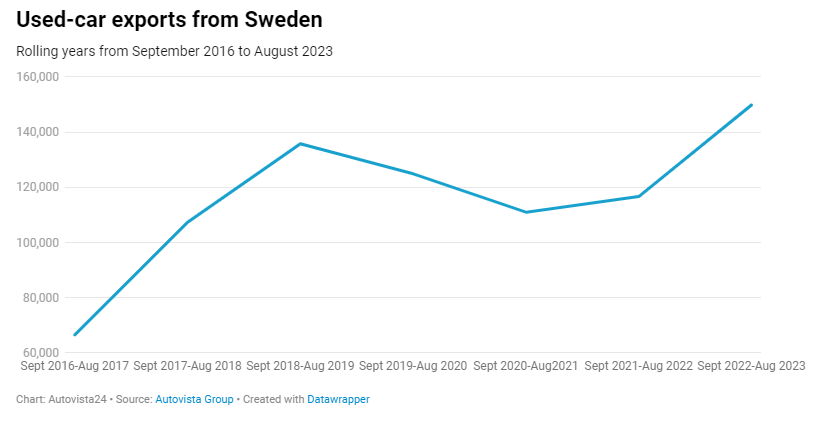

In recent years, new-car sales have fallen while used-car export rates have risen. This has resulted in declining supplies of three-year-old used cars in Sweden, which has generated higher prices.

Record levels of used-car exports have been driven by a weak Krona. A quarter of these shipped models have been funnelled to Finland, where the average vehicle is three years old. As many new-car leasing contracts are three years in length, this puts Sweden’s exports in a primary position.

Since January 2023, average new car list prices have increased by 3.1%. Meanwhile, BEVs have gone against this trend, up only 0.4%. This has been a positive development for all other powertrains, as rising new-list prices usually inflate used-car prices.

EV list price development has also suffered a great deal of uncertainty recently. This has given potential purchasers pause for thought, as they wait for prices to fall lower. In the interim, these consumers may look to cheaper ICE models. Previously proposed Euro 7 rules have also likely had a marginal effect, as they were supposed to shrink the upcoming supply of petrol and diesel-powered cars.

What to expect

What does all this mean for Sweden’s automotive market moving forward? Delayed demand for new and more expensive used cars will reach a tipping point when the economic situation sees improvement and relatively higher interest rates are normalised.

Consumers will need to swap over to newer vehicles eventually when their older used cars are no longer fit for purpose. This could affect older and affordable cars as a great number of exchanged vehicles are handed over to dealers. If exports remain high with more used cars heading abroad, the domestic market will see supply sink lower.

Used-car supply in Sweden can be expected to remain low until at least 2027, which means higher average prices will persist for longer. Additionally, if Euro 7 regulations are weakened, as currently seems to be the case, more ICE models can be expected on the streets, weakening demand for EVs.

Detta innehåll presenteras till dig av Autovista24.

Stäng

Stäng